DETAILS

- Fee None by Harmers the Bank will charge a fee

- Location ENGLAND

- Category Domestic, International, Payment Methods

ABOUT

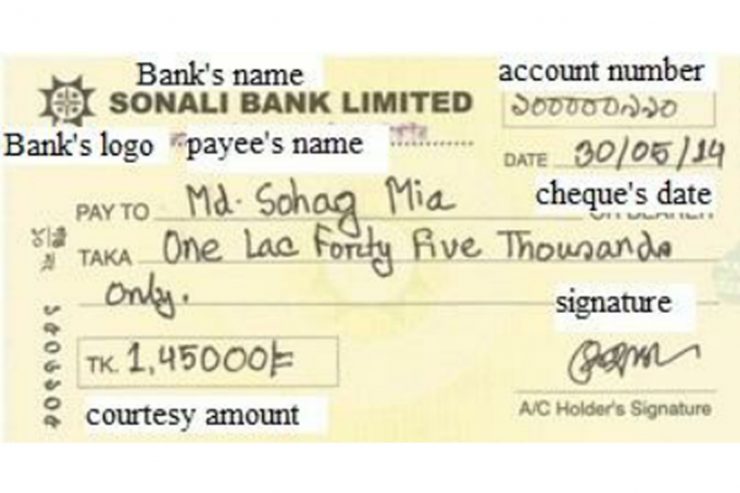

The Automated Clearing House (ACH) network is a system for moving money between bank accounts in the US. It’s the direct evolution of the paper check—just transformed into a digital process to improve efficiency and reduce the need for human inputs. It’s often referred to by functional nicknames like direct deposit, direct debit, auto-pay, and the generic term “bank transfer”. It’s also the underlying technology behind most peer-to-peer transfers made through services like Venmo, PayPal, Cash App, and Zelle.

ACH transfers can occur between any two financial institutions on the network, and can either push or pull money through the system as needed. Each transaction is submitted to the network as part of a batch, which the network’s operators repackage into new bundles for each receiving institution 5 times per business day. The party initiating the request can either choose to pay for same-day service or default to one business day (for debits being pulled through) or two business days (for credits being pushed through).

REMEMBER TO INCLUDE ALL FEES – Banks like to pass the cost on to the recipient to hide the cost of sending and receiving wires. As the sender, you will pay your bank’s fee, typically $10-$15. You MUST pay for those fees. Our bank charges $15 to receive the wire, but Harmers pays our bank fees. PLEASE, Pay ALL your Bank Fees.

There are two types of ACH Payments, 1 day and 3 day. ACH is not available for many international transactions.

NOTES:

The history of ACH go back to 1968, when a group of California bankers became concerned about the growing volume of paper checks. They feared it could outpace the technology and equipment used to clear those checks. So they formed the Special Committee on Paperless Entries, or SCOPE.

Around the same time, the American Bankers Association sponsored a study looking at ways of improving the nation’s payment system.

These events led to the 1972 formation of the first ACH association in California to handle electronic payments. Other regional ACH networks soon appeared and in 1974 they formed Nacha to administer the ACH Network.

As the administrator, Nacha sets and enforces the Rules for ACH and educates people about the network. What it doesn’t do is operate the physical network. That’s up to the ACH Operators: the Federal Reserve and The Clearing House. They do the actual processing and routing of transactions—“moving the money,” if you will.

Nacha’s establishment led to the first national ACH Rules being drafted, and that in turn paved the way for the very first standard ACH format for Direct Deposit. The U.S. Air Force soon became the first employer in the nation to initiate a Direct Deposit payroll program. Today, Direct Deposit is so popular that it’s the way 94% of Americans get paid.

WHY CHOOSE

- Inexpensive

- 2-5 days processing

- Secure.